Why Did You do All This in the First Place?

When I ask lawyers why they decided to jump off the employee cliff and open their own practice, I get a few different answers, but almost answers revolve around two things. Time and money.

You want more time with your family and do the things you love doing (besides practicing law). You also wanted a plethora of funds to support this. It would make sense that you now monitor these two things, time and money, like a hawk to make sure you’re getting what you originally set out to get from all this, right? Nope, in fact many practice owners run from basic accounting requirements (if this is you, for the love of law please keep reading). So why are you running from the thing you set out to gain?

If you’re the guy or gal that only looks at financials but doesn’t use them to make business decisions, passes this type of stuff off and never wants to see it, or if you avoid doing it all together, you’re certainly not alone. Most lawyers deal with this burden out of fear that Uncle Sam is going to show up at the front door.

Look, we accountants know that this crap is boring. Trust me, it’s not the monthly data entry that we get off on. It’s what you can do with that compiled information that creates the magic. But let’s not get ahead of ourselves here.

Business Lessons From a 6th Grade Science Teacher

I had a science teacher in the 6th grade, his name was Mr. Peters (shout out Mr. Peters if you became a lawyer since then and are reading this!). At the start of the school year he made a bold statement to the class and invited anyone to challenge him and prove him wrong. He said, everything in the world can be tied to science. One by one we tried to come up with something that would prove him wrong. We got creative folks, I mean we really tried! We tossed out things like the exit sign hanging over the door, shoes, dogs, butts (I don’t specifically remember that one but I’m sure our 6th grade minds went there). By the time we were done he had defeated us. I still think about possible come-backs to Mr. Peters, so If you’ve got a suggestion please let me know because I’d love to find Mr. Peters and submit another challenge.

I had a science teacher in the 6th grade, his name was Mr. Peters (shout out Mr. Peters if you became a lawyer since then and are reading this!). At the start of the school year he made a bold statement to the class and invited anyone to challenge him and prove him wrong. He said, everything in the world can be tied to science. One by one we tried to come up with something that would prove him wrong. We got creative folks, I mean we really tried! We tossed out things like the exit sign hanging over the door, shoes, dogs, butts (I don’t specifically remember that one but I’m sure our 6th grade minds went there). By the time we were done he had defeated us. I still think about possible come-backs to Mr. Peters, so If you’ve got a suggestion please let me know because I’d love to find Mr. Peters and submit another challenge.

Like Mr. Peters and his science challenge, I challenge you to think of something that doesn’t have to do with numbers in your legal business. Seriously, what does your firm do that cannot be tied back to your finances? Think about it, then if you think you’ve got something please let me know so I can pull a Mr. Peters on you. Almost everything you do in your firm can be translated into numbers and money.

Alright, alright, now that we’ve established what you SHOULD NOT do with your books, let’s get clear about what a good accounting system SHOULD do for your firm.

A few housekeeping tasks

Before you can create the financial picture of where your legal practice stands, you must set a solid foundation on which to build your financial house.

Garbage in = garbage out

If you’ve never heard this saying before, please remember me as the one who introduced this to you, because then I will feel special. Think of… Mexican food. There you go, now you’ll remember! Same idea with your books. If you’re missing bank accounts, credit card transactions, cash receipts, transactions are not being properly coded, bank accounts are not being reconciled, or you’ve got a case management software that isn’t communicating properly with your accounting software, Houston we’ve got garbage going in and therefore garbage coming out. If you’re not sure about the quality of data that you’re feeding your books PLEASE, for the love of law, ask an accountant to review your bookkeeping processes.

Your Law Practice Management Software (LPMS) should match your books should match your bank account and what auditors look at

As accountants, it’s our goal to keep you in compliance so that, if you are ever audited, you don’t end up with a terrifying bill. Let me tell you one of the easiest ways for an auditor to find discrepancies in the books of those who don’t know any better (sorry not sorry Mr. Auditor). Let’s say you use LPMS and an accounting software. Mr. Auditor is going to ask you for revenue reports from LPMS for the entire audit period in question. Then he’s going to compare those side-by-side to not only your accounting software but to your bank statements and the tax return for that period. Here’s what they usually find:

2018 Revenue

LPMS says: $750,000

Accounting Records say: $725,000

Bank Statement says: $723,000

Tax Return claimed: $725,000

Guess what Mr. Auditor is going to do? He’s going to take the highest revenue reported (LPMS coming in at $750,000) compared to what you reported on your tax return ($725,000) and cut you up for the difference. Now you’re the one who’s guilty until proven innocent. That’s $25,000 that you’re going to owe additional taxes on and you can bet your tail that there’s going to be penalties and fees to boot. Now, hopefully you don’t roll over so easy and do a little digging to find an honest mistake. Maybe you had a case that settled, and you were supposed to get $25,000 but everything fell through and you just forgot to let LPMS know that. See how your software’s communicating is so important?

Your COA should be in line with your practice area(s) and tell a story

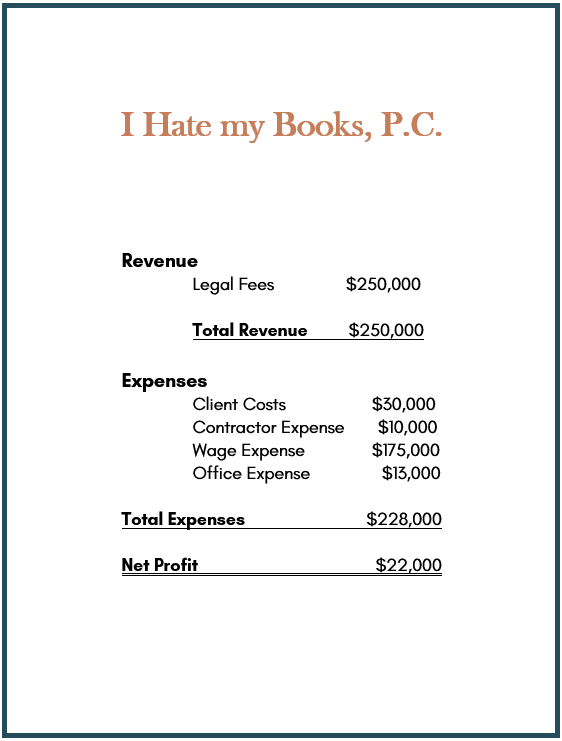

Yay, this is my favorite! Yes people I’m a nerd, I’m well aware and I own my nerdiness ery-day. I’m going to make this short and sweet. If your books look like this:

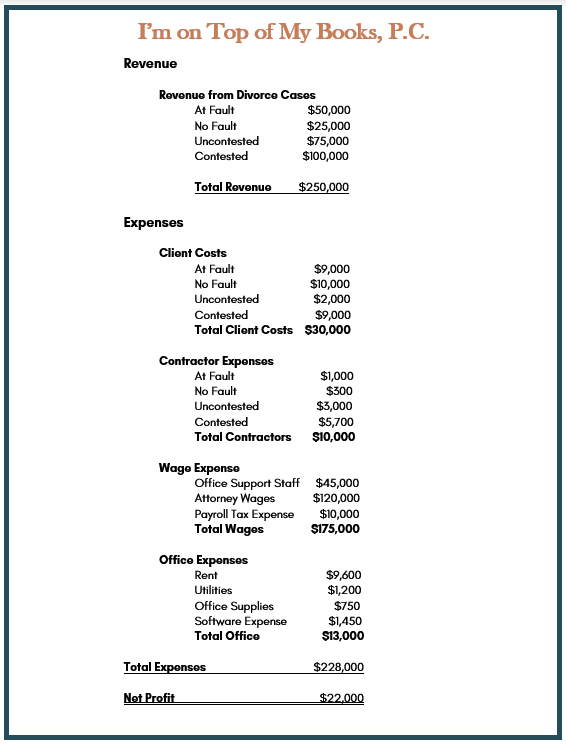

You’re going to want to work on getting them to look like this:

Now while these examples are super generic and made up, they prove a point. What point is that? I’m so glad you asked! In example #1, the only thing I can tell you about your legal business is that you’re profitable, but we have no idea why that is. In example number 2 I can tell you that your most profitable service is by far, uncontested divorce cases with a 93% gross profit margin before overhead expenses. I can also tell you that your least profitable service is no fault divorce cases coming in with a 59% gross profit margin before overhead. Based on this, you’ll want to look for areas to either cut down time involved, automate processes, increase your fees, or a combination of the three.

Wham bam, thank you financials! Now you feel like a powerful legal business owner, don’t you? In TOTAL control of your numbers and the sky is the limit.

Why you REALLY started your own legal business

There’s a third reason why a lot of the lawyers go into practice for themselves. I didn’t mention it to you before now because so often lawyers lose it underneath the burden of running a legal business. You, my lawyer-friend wanted to make a difference in the lives of the people you serve. You care (even if your clients think you don’t). When your financial house is in order, you are free to do just that, impact your clients lives in a positive way. You can keep your passion and not get lost in running a legal business. You don’t have to be worn down until your passion for practicing law diminishes. You don’t have to end up like Tim, and numbers are one of the key tools you can use to achieve this.

When you know better, it’s your responsibility to do better.

Now, go do better legal warriors!

All opinions, advice, and experiences of guest bloggers/columnists are those of the author and do not necessarily reflect the opinions, practices or experiences of Solo Practice University®.

Comments are closed automatically 60 days after the post is published.